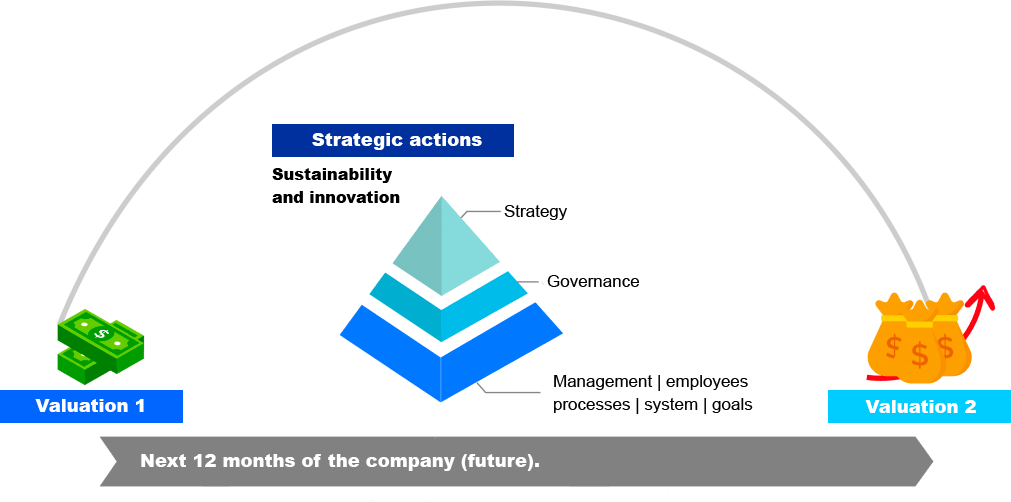

Through its multidisciplinary team that serves the entire national territory, Valore Brasil offers the service of Valuation consultancy to all clients, performing an initial Valuation and suggesting organizational structure changes such as capital changes, products mix, investments, establishment of sale prices and etc., able to transform the business economic result.

Then, the Valuation consultancy measures again the company valuation in order to obtain an objective quantitative measure of the impact of the management work on applying the improvements suggested and so increase the company’s value.